Expert Social Security and Medicare solutions

You deserve a future designed with precision and care. Gain clarity and peace of mind.

A thoughtfully devised plan helps reduce taxation and lets you keep more of your money

Planning enables the identification of optimized Social Security election strategies, versus simply maximized

Careful planning allows self employed business owners to identify SECA tax minimizing measures and control income to reduce Medicare costs after retirement

Mission Statement:

Empowering Financial Independence

At Wish We Started Sooner, we believe that starting is the most important thing, regardless of where you are starting from. We challenge the broken traditional ways of retirement, long-term care planning, and end-of-life transitions, striving to empower individuals to take control of their financial future.

Core Values

Accessibility: We are committed to making information and knowledge accessible to everyone, regardless of their financial situation.

Integrity: We stand firmly against predatory sales, lending, and financial practices, ensuring trust and transparency in all dealings.

Innovation: We reject one-size-fits-all planning and lazy financial practices, constantly seeking innovative and clever solutions for each client.

Purpose

Our mission is to sound the alarm for those at risk of future financial hardship, showing that it's possible to break the cycle of generational poverty. We aim to improve the quality of life for as many people as possible, helping them plan for the expenses they will face in their later years. By demystifying the 'game' of life that often feels rigged against the disadvantaged, we help relieve people from systemic oppression.

We believe that providing everyone with the knowledge to achieve financial comfort fosters a kinder, more compassionate society.

A NETWORK OF TRUST

Connecting You with the Right Experts for You

WHO WE HELP

Everyone can benefit from our service

our ideal client is you

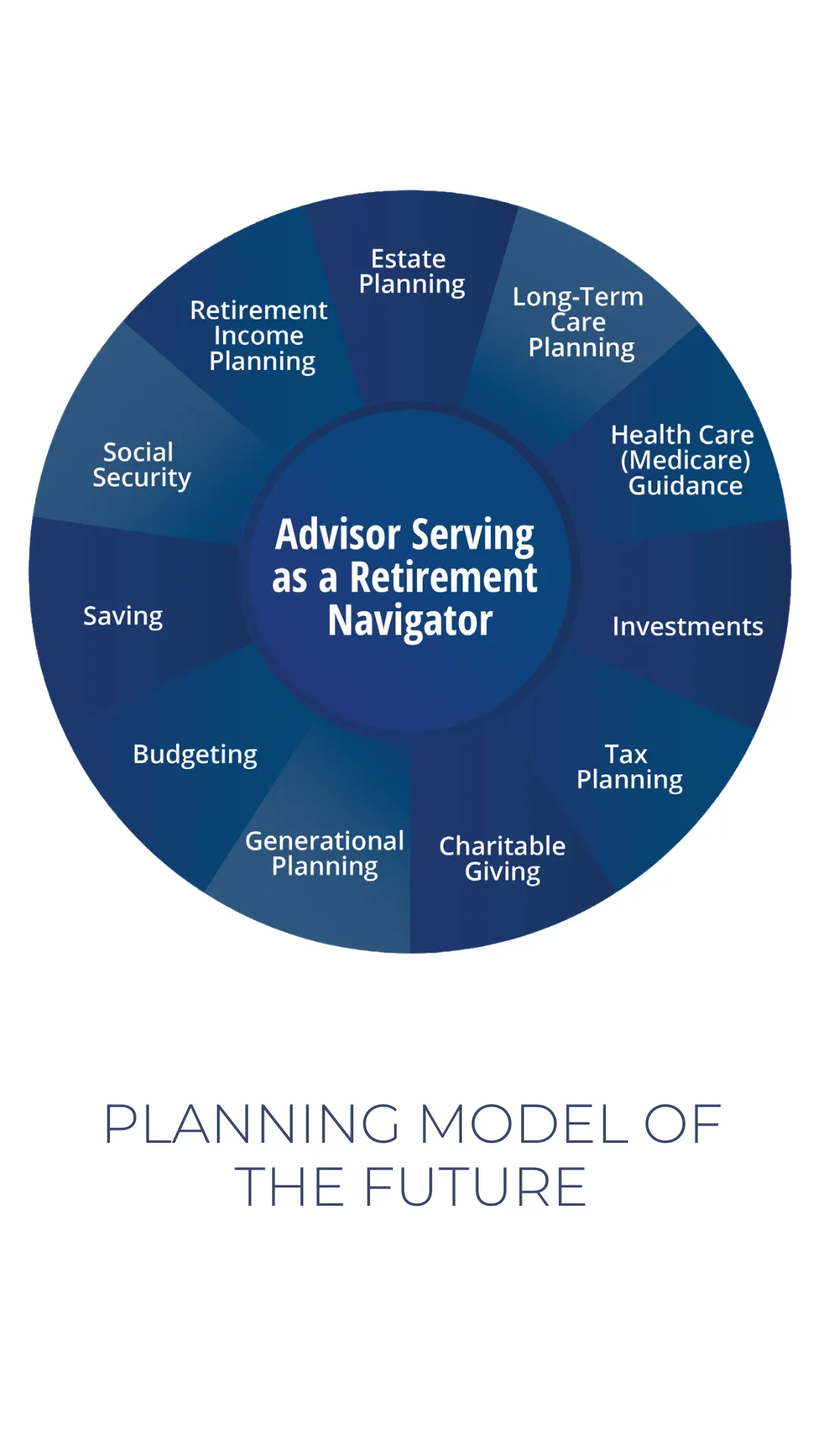

Retirement Planners

We specialize in helping those preparing for retirement optimize Social Security income over their lifetime, reducing taxation, and ensuring a secure and comfortable future. We provide a comprehensive social security analysis, assessing your earnings history, reviewing various claiming scenarios, and strategizing the optimal time to claim benefits while minimizing taxes.

Widows and Survivors

We offer compassionate and expert assistance to widows and dependent survivors in electing the benefits they are entitled to, providing a sense of relief and peace of mind during a difficult time.

Self-Employed Individuals and Business Owners

For those who are self-employed, I provide tailored strategies to reduce their SECA taxes nearing retirement and maximize their Medicare and ACA benefits, empowering them to have the coverage they need without unnecessary costs.

High-Earning individuals and couples

Individuals that earn more than $85k and couples who earn more than roughly $195k per year could be subject to an Income-Related Monthly Adjustment (IRMMA) for Medicare Part B and D by the Social Security Administration. They can benefit significantly from my expertise in navigating Medicare costs.

Our working Process

Discovery Phase

During our free consultation, I will take the time to understand your unique needs and goals. This includes comprehensively assessing your budgets, potential risks, and future estate planning requirements. This step ensures we are aligned and focused on your specific objectives.

Social Security Review

Following the discovery phase, I will conduct a detailed review of your social security status. You will receive a comprehensive report outlining strategies to maximize your benefits and ensure financial stability during retirement.

Health Insurance Review

In this step, I will evaluate your health insurance coverage, identify benefit areas to reduce costs, and recommend

adjustments. including tax credit opportunities and tax advantaged planning. This also includes Medicare and Part D

NOK Box & Document Preparation

The final phase involves preparing essential end-of-life documents and setting up your Next of Kin (NOK) box. I will also connect you with trusted professionals for additional services such as wills, Power of Attorney (POA), medical directives, or financial planning.

COMPANY

CUSTOMER CARE

LEGAL

FOLLOW US

Innovation

Fresh, creative solutions.

Integrity

Honesty and transparency.

Excellence

Top-notch services.

Copyright 2024. Wish We Started Sooner, LLC Appleton, WI 54911 - All Rights Reserved.

Not affiliated with or endorsed by any government agency

The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex