Frequently Asked Questions

How does working with an RSSA differ from speaking with a government Social Security employee?

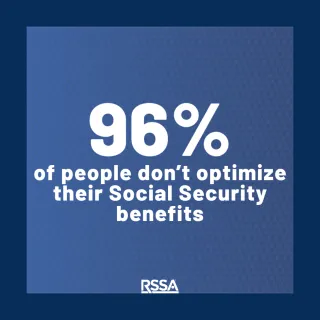

Government Social Security employees can provide information about your benefits and how to apply, but they are restricted from offering personalized advice or making recommendations. An RSSA, on the other hand, can analyze your individual situation, offer customized strategies, and give advice on the best ways to maximize your benefits.

What is a Registered Social Security Analyst (RSSA)?

An RSSA is a trained professional who specializes in providing detailed analysis and personalized strategies for optimizing your Social Security benefits. They assist clients in understanding complex Social Security regulations and making informed decisions. Some have a fee, some do not. They are not paid by the government.

Can an RSSA offer opinions and recommendations?

Yes, an RSSA is qualified to offer professional opinions and recommendations tailored to your specific circumstances. Unlike government employees, RSSAs can provide strategic advice to help you make the most of your Social Security benefits.

Why choose an RSSA or an insurance agent over government sources?

Choosing an RSSA or an insurance agent allows you to benefit from expert advice and personalized recommendations that can help you maximize your Social Security benefits and select the right insurance plans. Government employees are limited by law to providing information without giving personalized advice.

How can an insurance agent assist with Medicare and Part D plans?

An insurance agent can compare different Medicare and Part D options, explain coverage details, and help you choose the plan that best fits your medical and financial needs. They can also assist with the enrollment process and answer any questions you may have about your coverage.

Do I really need an estate plan?

Estate planning involves creating a plan for how your assets will be managed and distributed after your passing. It's not just for the wealthy; it's about ensuring your wishes are carried out and minimizing stress for your loved ones during a difficult time. Through estate planning, you can specify beneficiaries for your assets, designate guardians for minor children, and even make provisions for charitable contributions. Estate planning can also help minimize estate taxes, legal fees, and potential conflicts among heirs. By putting a comprehensive plan in place, you provide your family with clarity and financial security, ensuring that your legacy is preserved and your loved ones are taken care of according to your wishes.

COMPANY

CUSTOMER CARE

LEGAL

FOLLOW US

Innovation

Fresh, creative solutions.

Integrity

Honesty and transparency.

Excellence

Top-notch services.

Copyright 2024. Wish We Started Sooner, LLC Appleton, WI 54911 - All Rights Reserved.

Not affiliated with or endorsed by any government agency

The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex